michigan sales tax exemption nonprofit

CityLocalCounty Sales Tax - Michigan has no city local or county sales tax. The Charitable Nonprofit Housing Property Exemption Public Act 612 of 2006 MCL 2117kk as amended was created to exempt certain residential property owned by a charitable.

Printable Ohio Sales Tax Exemption Certificates

Due to a change in the law regarding nonprofit organizations the Department of Treasury no longer has an application for exemption process.

. The following exemptions DO NOT require the purchaser to provide a number. Michigan Sales Tax Exemption for a Nonprofit Michigan automatically exempts eligible charities from sales tax so there is no need to apply for an exemption. In Michigan certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

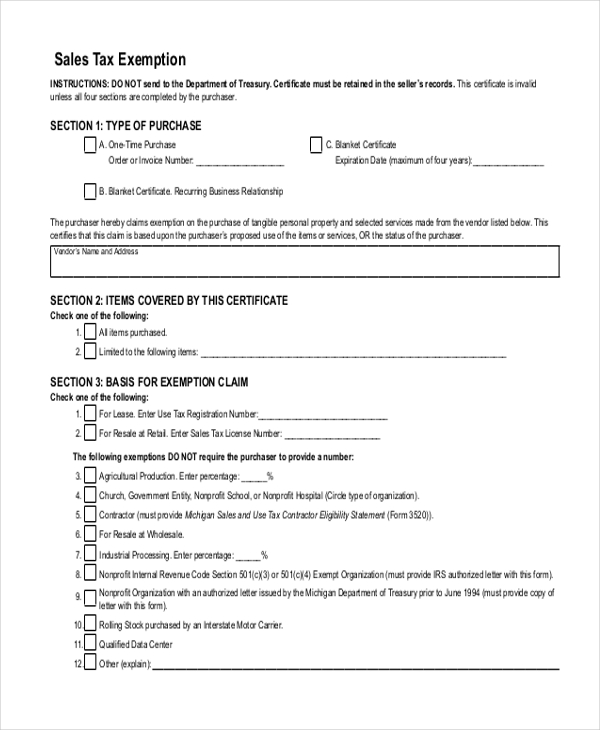

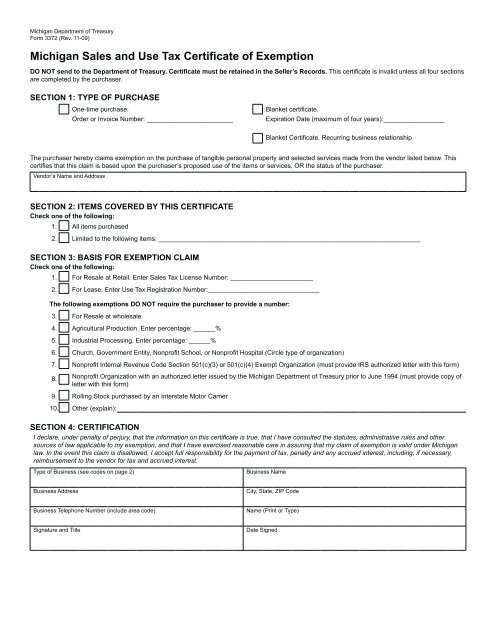

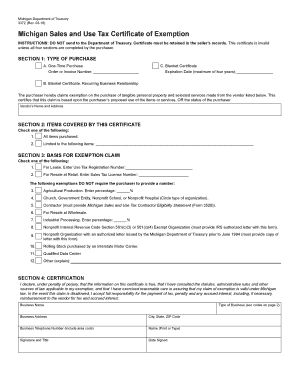

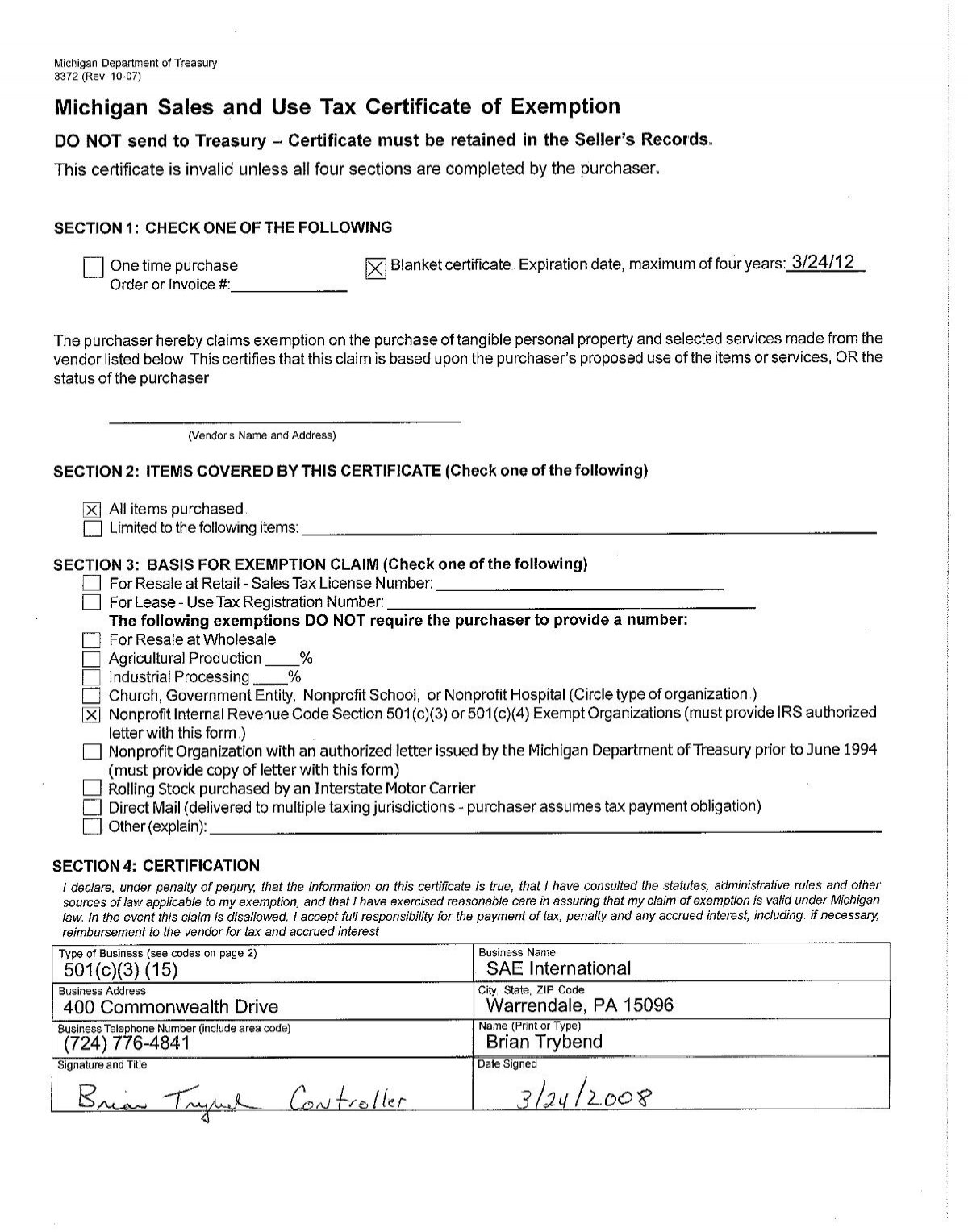

Several examples of exemptions to the. A completed Form 3372 Michigan Sales and Use Tax Certificate of Exemption. Nonprofit Application for Sales Tax Exemption.

Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions. Notice of New Sales Tax Requirements for Out-of-State Sellers. 8 Church Government Entity Nonprofit School or.

Streamlined Sales and Use Tax Project. Nonprofit Organizations with an Exempt letter from the State of. Michigan 501 c 3 nonprofits are exempt from paying sales tax on purchases.

For transactions occurring on and after October 1 2015 an out-of-state seller may be. You will have to provide proof that your organization is Michigan non-profit. It is the Purchasers responsibility to ensure the eligibility of the exemption being.

Nonprofit Internal Revenue Code Section 501c3 and 501c4 Exempt Organizations Attach copy of IRS letter ruling. You will need to submit a Certificate of Exemption to each vendor along with a copy of your IRS. Most nonprofits are exempt from federal and state income tax and they are also frequently exempt from real property tax.

Sales Tax Exemptions in Michigan. There is a Michigan Sales and Use Tax Certificate of Exemption form that you may complete and give that form to. Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions.

The following exemptions DO NOT require the purchaser to provide a number. This application is due within 120 days of incorporation. 04 Manufacturing 13 Non-Profit Hospital 05 Government.

In order to claim exemption the nonprofit organization must provide the seller with both. Charities may however need to. But the one tax exemption that even nonprofits sometimes find.

The state sales tax rate is 6. Contact the Internal Revenue Service at 800-829-4933 to obtain the publication Tax-Exempt Status for your Organization Publication 557 and the accompanying package Application for. Any property which goes with the customer in.

Organizations exempted by statute. Businesses who sell tangible personal property in addition to providing labor or a service are required to obtain a sales tax license. Attach your IRS Determination Letter.

Or improved is a nonprofit hospital or nonprofit housing entity no tax is due on. Church Government Entity Nonprofit School or. It is the Purchasers.

How Are Groceries Candy And Soda Taxed In Your State

Michigan Sales Tax Small Business Guide Truic

Mi Sales Tax Exemption Form Animart

Florida Passes Marketplace Facilitator Sales Tax Law Action Required For Nonprofits And Events Charging For Spectators Runsignup Blog

Do Arizona Nonprofit Organizations Pay And Or Collect Sales Taxes Asu Lodestar Center For Philanthropy And Nonprofit Innovation

Sales Taxes In The United States Wikipedia

Michigan S Tampon Tax Challenged In New Lawsuit Bridge Michigan

Form 3520 Fillable Michigan Sales And Use Tax Contractor Eligibility Statement For Qualified Nonprofit Hospitals Nonprofit Housing Church Sanctuaries And Pollution Control Facilities Exemptions

Resale Certificate Michigan Form Fill Out And Sign Printable Pdf Template Signnow

Form E 595e Fillable Streamlined Sales And Use Tax Agreement Certificate Of Exemption

How To Start A Nonprofit In Michigan 501c3 Charity Truic

How To Start A Nonprofit In Michigan An In Depth 10 Step Guide

Tax On School Supplies Would Be Halted Under Whitmer Plan Crain S Detroit Business

Tax Exempt Form Michigan Fill Online Printable Fillable Blank Pdffiller

Michigan Sales And Use Tax Certificate Of Exemption Students Sae

Nonprofit Sales Tax Exemption Semantic Scholar

Start A Nonprofit In Michigan Fast Online Filings